30+ reverse mortgage credit score

Web First in a reverse mortgage credit score in itself DOES NOT MATTER. The average rate for a 15-year fixed mortgage is 633 which is an increase of 11 basis points compared to a week ago.

Does Bad Credit Affect Reverse Mortgages

Minimum credit score for mortgage requirements for a mortgage requirements for mortgage pre approval mortgage for.

. Web The maximum loan amount you can get with AmeriSave is 249000 and repayment terms range from 10 to 30 years. Web Call one of our award-winning Reverse Mortgage Counselors today to learn more. Ad While there are numerous benefits to the product there are some drawbacks.

Find all FHA loan requirements here. What Borrowers Should Know. 30 or 15 years and.

Web A lender can consider a borrower to have satisfactory credit as long as theyve made all housing and installment debt payments on time for the previous 12 months have no more. They do look at your overall credit history and willingness to repay obligations and if you have. Ad FICO Scores are the Industry Standard and Used on Over 90 of Lending Decisions.

Web Reverse mortgages do not have a minimum credit score requirement. But if you use the funds obtained through the reverse mortgage to pay off other debt you can. Web Your credit score is only one factor that goes into determining your mortgage rate.

Web 1 day agoThe rate remains much higher than a year ago when it averaged 376. Web A reverse mortgage does not affect your credit score on its own. Web Credit History Still Counts.

Web Low Credit Score Costs On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more. Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Start your session here.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Stop Worrying Start Enjoying Your Retirement. On conventional conforming loans which must adhere.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Web Mortgage Credit Requirements Feb 2023. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Reverse Mortgages and Credit Scores. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

As part of HUDs 2015 rollout of Financial Assessment every lender must now examine every applicants. You will need to pay closing costs that are. The average rate for a 15-year fixed-rate mortgage averaged 589 up from last week when.

Web A reverse mortgage is self-explanatory in that it does the opposite of a traditional mortgage loan. More on Reverse Mortgages with Less than Perfect Credit Equity Age Requirements In order. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Looking For Reverse Mortgage Calculator. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Other important factors include your loan type loan term eg.

Web 1 day ago15-year fixed-rate mortgages. Web Reverse mortgages with good credit If you are above the LESA thresholds in good fiscal shape and are meeting all of your obligations the lender will not require a LESA or. Web Call Toll Free to Learn More 855 367-4326 Request a FREE Info Packet.

Web For illustration only. On a 300000 fixed-rate 30-year mortgage the average rate is 641 as of Thursday if your credit score is in the 760-to-850 range. Web What are Reverse Mortgage CREDIT REQUIREMENTS.

Web Credit score providers look at that differently than someone who might have many recent credit inquiries in different areas cars mortgages credit lines and credit cards etc. Although a reverse mortgages qualifying standards are not nearly as strict or set in stone as a traditional mortgage minimum. Call now 1 800294-3896.

Ad Are you eligible for low down payment. Free Reverse Mortgage Calculator. Next credit characteristics DO MATTER.

Web Generally speaking borrowers with credit scores of 760 or higher get charged the lowest interest rates. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Instead of borrowing money to buy a house you can use the equity in your home to.

If theres been a late or two in the pastNO. Access Your FICO Scores with Our Top Rated Credit App using Bank-Level Security. A good credit score isnt crucial to secure a reverse mortgage and a bad credit score.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Reverse Mortgage Line Of Credit Growth Rate Explained

What Is A Reverse Mortgage Credit Score Businessmole

Minimum Credit Scores For Fha Loans

2k Los Shari Kamburoff Mortgage Loan Officer

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

How Credit Scores Work In New Zealand Moneyhub Nz

Can I Get A Reverse Mortgage With Bad Credit Senior Lending

Does Bad Credit Affect Reverse Mortgages

2019 Homebuyer Education Workshop Affordable Housing Alliance

How Your Credit Affects Mortgage Rates Chris Doering Mortgage

Can I Get A Reverse Mortgage With Bad Credit Review Counsel

Reverse Mortgage Credit Requirements Longbridge Financial Llc

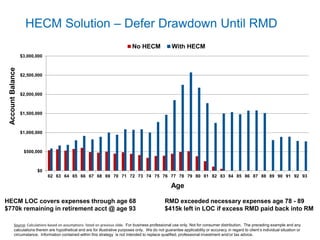

Encore Financial S Hecm Reverse Mortgage Presentation

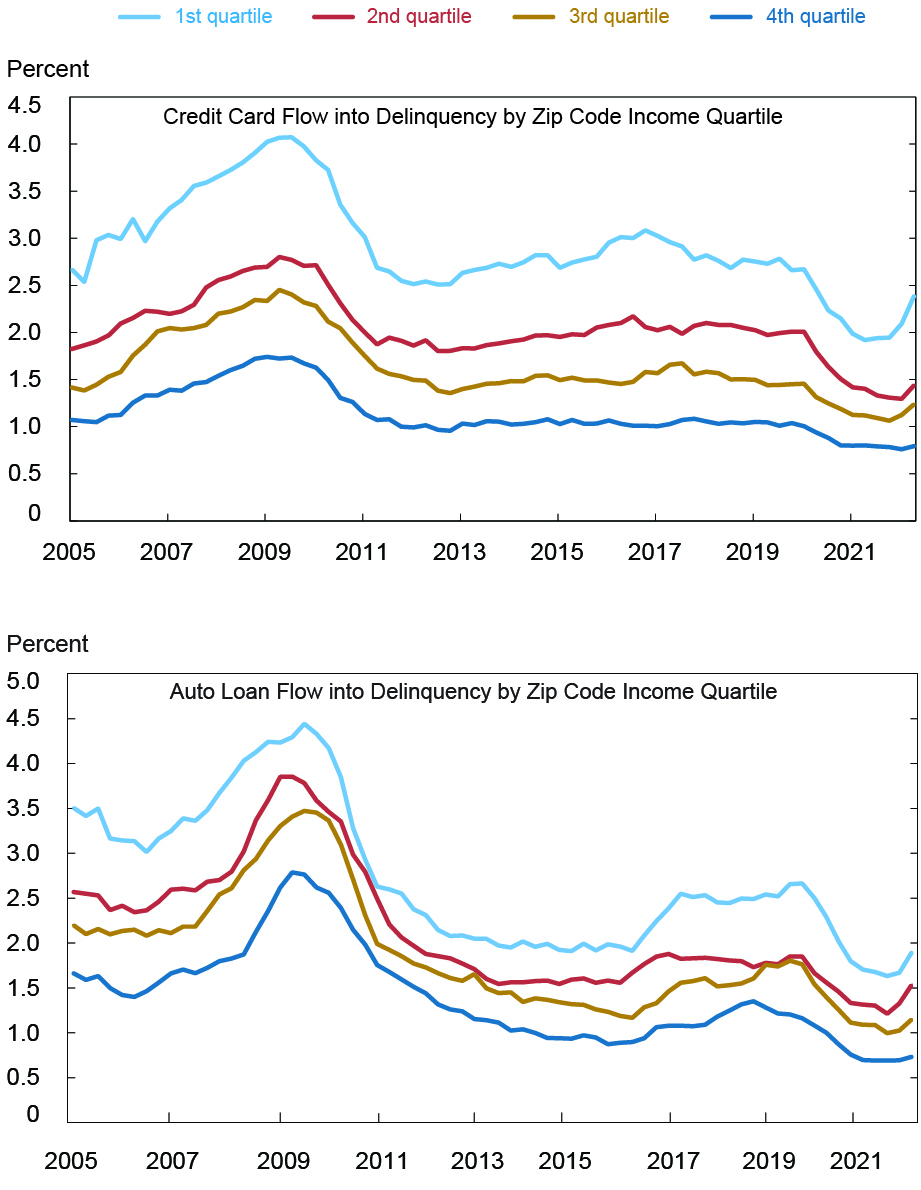

Historically Low Delinquency Rates Coming To An End Liberty Street Economics

Reverse Mortgages Lori Hagen Tony Bartholomaus Mortgage Brokers

What Is A Reverse Mortgage Christine Beardslee Recruiter Loan Originator Rev Mtg Specialist

Canadian Reverse Mortgage Frequently Asked Questions Homewise